Weekly Market Update - 17th February 2025: Tariff Reconsideration and UK Growth

Last week’s performance – major stock markets

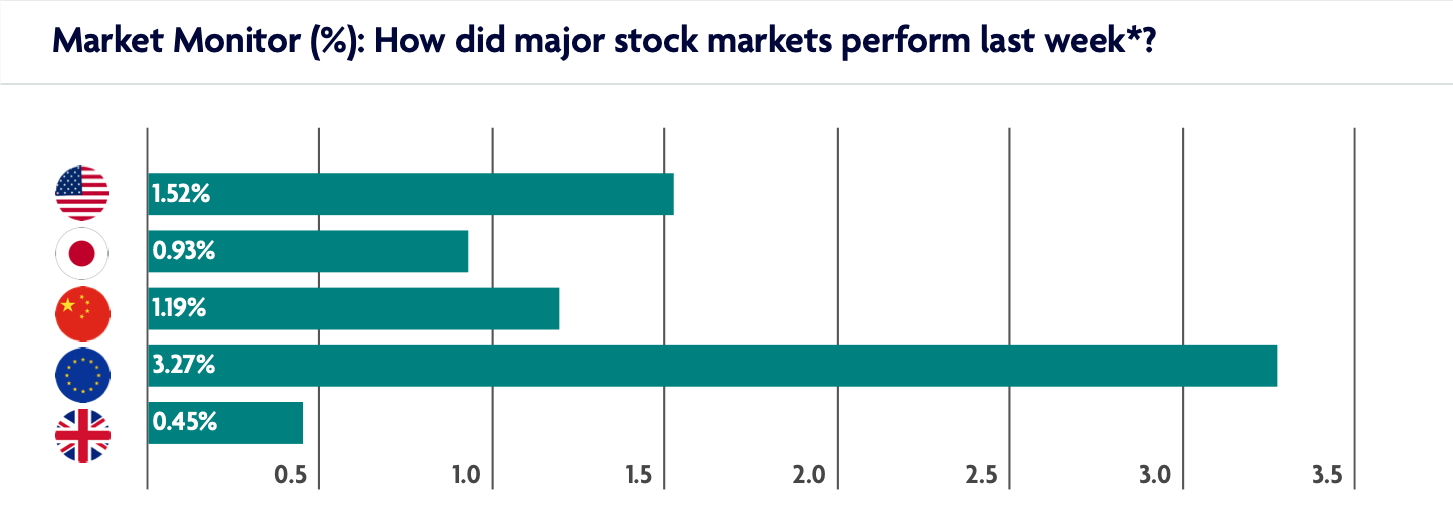

President Trump's reconsideration of tariffs was the biggest driver of markets last week, especially in Europe and China where there has been concerns over their implications. In the UK, unexpected GDP growth for Q4 2024 was taken well by markets, and separately, Bank of England policy makers spoke publicly following the last UK interest rate cut.

Key stories from last week

US stocks had a good run last week with the S&P 500 index finishing 1.5% higher. Stocks had their best day of the week on Thursday, largely in response to President Donald Trump’s decision to not introduce new global tariffs, instead signing an order that—following further study—could lead to the implementation of reciprocal tariffs on a country-by-country basis by April 1. While the news left some uncertainty, investors appeared to be encouraged as the move will further delay the implementation of additional tariffs and seemingly allow room for negotiation between the U.S. and its individual trade partners.

Europe was a standout performer last week rising 3.3%. The main driver for this uptick in stock prices was the news of delayed tariffs from the US. Europe has seen stock prices move lower as the prospect of tariffs has been spoken about, and this news of a potential delay has allowed stock prices to recover.

It was a busy week in the UK last week, where the FTSE 100 ended 0.5% higher. Britain's economy unexpectedly grew by 0.1% in the final quarter of last year, according to the Office for National Statistics (ONS). Analysts had forecast gross domestic product (GDP) would shrink by 0.1%, but growth of 0.4% in December lifted the quarter. Separately, Bank of England (BoE) Chief Economist Huw Pill told a business group that policymakers must still be cautious about cutting interest rates because of continuing strong pay growth. Fellow Monetary Policy Committee (MPC) member Catherine Mann, previously one of the most pro higher interest rate members of the MPC, argued that the BoE should have cut rates by half a percentage point at its last meeting instead of a quarter point because a weakening labour market and slowing consumer demand were helping to subdue inflation.

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.