Weekly Market Update – 22nd April 2025: ECB Cuts Rates, US Tariff Tensions Weigh on Tech

Key Stories From Last Week

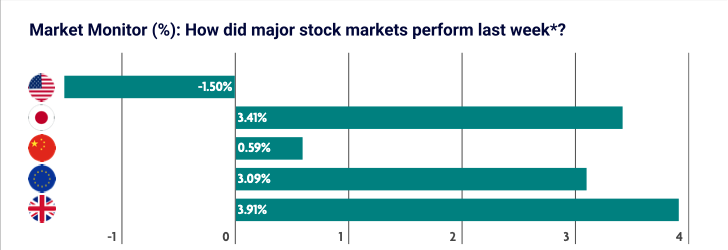

Global market returns, excluding the US, were broadly positive last week as investor sentiment continued to be dominated by US trade policy. Notably, the week saw the European Central Bank (ECB) cut its interest rate and also signal to markets that further interest rate cuts may be on the horizon.

US: Large technology stocks lead decline in holiday-shortened week

The US stock market closed lower over the week with large technology stocks leading the decline. This was due in part to the news that the US government would add new restrictions on exports of chips to China. The news sent the shares of NVIDIA and other companies with artificial intelligence (AI) exposure lower. Furthermore, comments from Jerome Powell, the Chair of the Federal Reserve (the US central bank), added to negative investor sentiment. Powell stated that tariff increases have been “significantly larger than anticipated” and that “the same is likely to be true of the economic effects, which will include higher inflation and slower growth.” This has cast doubt about the potential of any interest rate cuts in the near term. Elsewhere, we saw positive data on consumer spending ahead of the tariff increases. Retail sales rose by 1.4% in March and sales at motor vehicle and parts dealers increased 5.3% as consumers rushed to buy cars ahead of the Trump administration’s 25% tariff on automobiles.

Japan: Signs of progress in US-Japan trade negotiations

Investor sentiment was boosted by tentative signs of progress in negotiations between the US and Japan. A reminder that Japan is requesting that the tariffs imposed on its imports into the US be reviewed and more favourable trade terms be introduced. On the interest rate policy front, latest comments from the Bank of Japan (BoJ) were interpreted as cautious given the uncertainties arising from tariffs. Markets perceived these comments as suggesting a potential delay to the timing of its next interest rate hike. In a similar vein to last week, the Japanese yen again strengthened versus the US Dollar as the demand for the safe haven assets increased amid signs of an escalated trade war between the US and China.

China: Markets rise on expectations of stimulus to offset tariffs

Expectations that Beijing will ramp up stimulus to combat the impact of higher US tariffs boosted markets. China is facing 145% tariffs on most of their goods. Many global banks scaled down their 2025 growth forecasts for China over doubts that it can meet its official target of around 5% economic growth. Many economists believe that China has the financial capacity to offset the tariff impact through a combination of government spending and tax cuts. A meeting by the ruling Communist Party’s Politburo at the end of April will likely offer greater insight into officials’ thinking regarding the size and timing of any economic stimulus.

Europe: ECB cuts interest rate; signals cutting further

Investor sentiment was boosted by a combination of President Trump’s decision to delay imposing higher tariffs and the European Central Bank’s (ECB) signal that there would be more interest rate cuts. The week was marked by the ECB cutting its interest rate from 2.5% to 2.25%, which was largely expected by markets. While the ECB declared that the disinflation path is well on track, it warned that the outlook for growth has deteriorated due to trade policy uncertainty. As a result, market participants interpreted the signal from the ECB that it wants to further cut interest rates in the near term. This was positive for European markets.

UK: Inflation slows more than expected

Headline inflation in the UK slowed to 2.6% in March from 2.8% in February, which came in slightly below market expectations of 2.7%. Additionally, services inflation, which is closely monitored by policymakers, decelerated faster than anticipated, to 4.7% from 5%. Meanwhile labour market data showed that job vacancies declined to the lowest level in nearly four years, while the unemployment rate remained at 4.4%. The data indicates a drop in the demand for workers as employers face higher employment costs in the face of expected employers’ tax hikes in April. On the other hand, weekly average earnings, excluding bonuses, grew 5.9% in the three months through February compared with the same period a year earlier. The Bank of England are set to next meet in May, where they will decide upon whether they change the current interest rate of 4.5%. Contrasting signals in the labour market creates a dilemma for the Bank. The introduction of tariffs could also mean a delay to further interest rate cuts.

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.