Weekly Market Update – 23 June 2025: Markets Hold Steady as Geopolitical Risks Rise

A week dominated by developments in geopolitical tensions in the Middle East, which have escalated further over the weekend after markets closed. This update covers the week ending 20th June and is likely to be a key driver of markets in the coming week.

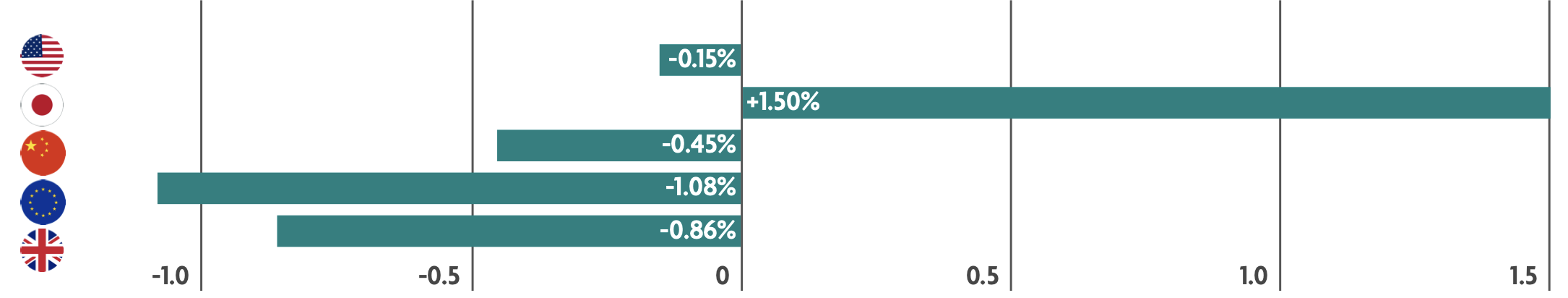

US: Stocks close mixed amid hopes for de-escalation in the Middle East

Markets were driven predominantly by news about tensions in the Middle East. For example, on Thursday, President Trump issued a statement noting that there was a “substantial chance of negotiations” with Iran in the near future, which seemed to provide some positivity for markets on Friday. In other news, the US Central Bank, The Federal Reserve, kept interest rates unchanged as widely expected. Jerome Powell, the chair of the central bank said that “despite elevated uncertainty, the economy is in a solid position,” and that the central bank remains “well positioned to respond in a timely way to potential economic developments.” Other economic news during the week was slightly disappointing, for example retail sales declined for a second consecutive month in May. Overall sentiment among home builders came in at the lowest reading since 2022, perhaps as buyers press pause amidst higher mortgage rates and uncertainty around tariffs and the economic outlook.

Japan: Trade talks and Interest Rates

While tensions in the Middle East heightened, the domestic focus was on the Bank of Japan, which left interest rates unchanged, as most investors expected. On the international trade front, the U.S. and Japan failed to reach an agreement on tariffs at the G7 summit. The U.S. is set to return its reciprocal tariffs to their higher levels on 9th July, which would increase the levies on Japanese imports from 10% to 24%.

China: Mixed economic data

A trio of indicators showed that China’s economy was on track to record solid growth for the second quarter. Retail sales rose 6.4% in May from a year ago. However, industrial output and fixed-asset investment year-to-date both increased less than expected. Earlier in the week, a report underscored the continued weakness in China’s property market. New home prices in 70 cities fell 0.22% in May from April, while used home prices fell 0.5%, both being in decline for months now. Ending a prolonged housing-driven slowdown is a key challenge for China’s leaders, who are trying to bolster domestic consumption longer term to insulate the economy from higher U.S. tariffs. However, the data suggested that the impact of a stimulus program that Beijing rolled out last September to support the country’s failing property market was wearing off.

Europe: Central banks cut rates, German investor morale surges but French manufacturing weakens

Beyond tensions in the Middle East, investors kept a close eye on central banks – and both the Swiss and Norwegian central banks cut interest rates this week. Elsewhere, investor morale in Germany rose more than expected in June so far, following the government’s approval of a large tax relief package earlier this month. Meanwhile, in France, manufacturing appears to be declining, and some are expecting manufacturing output to be flat this year.

UK: Bank of England holds interest rates and Inflation slows somewhat

All eyes were focussed on the Bank of England (BoE), who unsurprisingly left interest rates unchanged, citing elevated global uncertainty and persistent inflationary pressures. The Governor of the BoE Andrew Bailey said, "interest rates remain on a gradual downward path," although the central bank said it would take a "gradual and careful" approach to further rate cuts. In other news, inflation, or consumer prices, in the UK rose by 3.4% annually in May, down from 3.5% in April. Services price inflation—which is closely followed by the BoE—slowed to 4.7% from 5.4% in April, matching the central bank's forecast.

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.