Weekly Market Update – 28th April 2025: Markets Surge as Trade Tensions Ease

Key Stories From Last Week

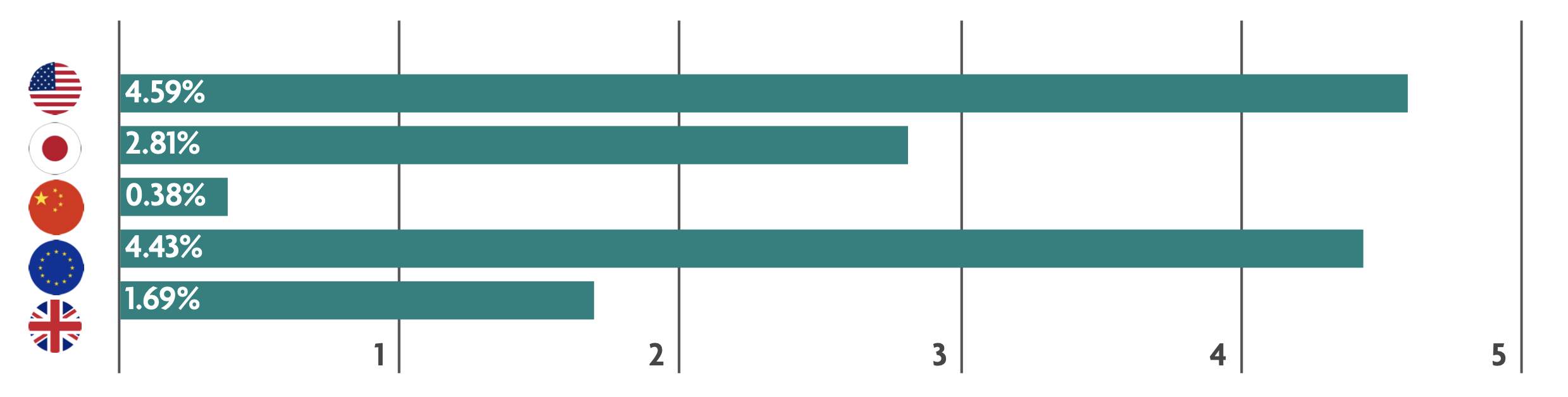

Global market returns were strong last week as trade tensions eased off and President Trump walked back on earlier comments about the chair of the US Central Bank. All eyes will continue on trades and tariffs, the impact these may have on economic growth and any stimulus from governments to ease the impact of these tariffs.

US: Trade tensions ease and President trumps softens tone on Fed Chair

Reports indicating that the ongoing trade tensions between the US and China in particular were calming down. Suggestions that short-term agreements between the US and other trading partners also supported markets as were the comments from President Donald Trump that appeared to walk back his recent threat to fire Jerome Powell, the chair of the US central bank, the Federal Reserve. Sentiment was also supported by some companies reported earnings that were higher than expected. In terms of economic activity, data suggests that growth in business activity in the US slowed during April, particularly notable in the services sector. The prices charged for goods and services increased at the fastest rate in over a year, with much of the increase attributed to the impact of tariffs. In other news, home sales dropped significantly in March and consumer sentiment has fallen for a fourth month straight. Against this expectation of slowing economic growth, US government bonds, known as treasuries, also delivered positive returns during the week.

Japan: Where next for interest rates?

Investor Sentiment was supported by tentative signs of easing in global trade tensions. Amid a decrease in demand for assets perceived as safer, the yen weakened against the U.S. dollar. Higher inflation in Tokyo, which is usually followed by higher inflation in the rest of the country, continued to support the case for further interest rate hikes by the Bank of Japan, although the central bank’s interest rate decision becomes more complicated by the uncertainty about the economic impacts of U.S. tariff measures. With trade discussions between Japan and the U.S. ongoing, Japan’s government announced a package of emergency economic relief measures to ease the impact of the higher U.S. tariffs on Japan’s economy. Japan has not yet received exemptions under the current tariff regime. Domestic industries such as automobiles and steel could be substantially hurt by the tariffs.

China: More stimulus likely on its way

Stocks rose amidst expectations that the government will roll out more stimulus to cushion China’s economy from the impact of U.S. tariffs. China’s Politburo—the ruling Communist Party’s executive policymaking body—said it would “fully prepare” emergency plans in response to external shocks. The group also said that China would set up new tools to boost technology, consumption, and trade and also pledged to go “all out to consolidate the fundamentals of economic development and social stability.” Till now, Beijing has been taking a patient approach toward supporting the economy amid the U.S. trade war. Most analysts see the impact of U.S. tariffs on China becoming evident in the short term after the Trump administration hiked total tariffs on most Chinese goods to 145% earlier in April. But China’s better-than-expected growth in the first quarter of 2025 and stimulus measures that the government outlined in early March have afforded Beijing more time in unleashing economic aid.

Europe: European Central Bank says recession unlikely

European markets rose significantly off the back of easing trade tensions between the US and China and President Trumps remarks towards Federal Reserve Chair Jerome Powell. The Chief Economist of the European Central Bank suggested that whilst tariff uncertainty would likely impact economic growth in Europe, a recession was unlikely given the European Union’s diversified trading relationships. That said, there are already signs of a bleaker economic outlook in Europe, with the German government expecting its economy to be flat this year and business activity dipping slightly, led by the services sector. On the flipside, the manufacturing sectors are showing business activity continuing to expand.

UK: Retail sales up but consumer confidence down

Beyond global headlines, we saw some positive data coming out of the UK. Retail sales volumes unexpectedly rose in March, whilst most economists were expecting a fall. On the other hand, though, rising energy bills and volatile financial markets has meant that consumer confidence dropped during the month of April.

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.