Weekly Market Update – 6th May 2025: Global Markets Rebound as Trade Tensions Ease

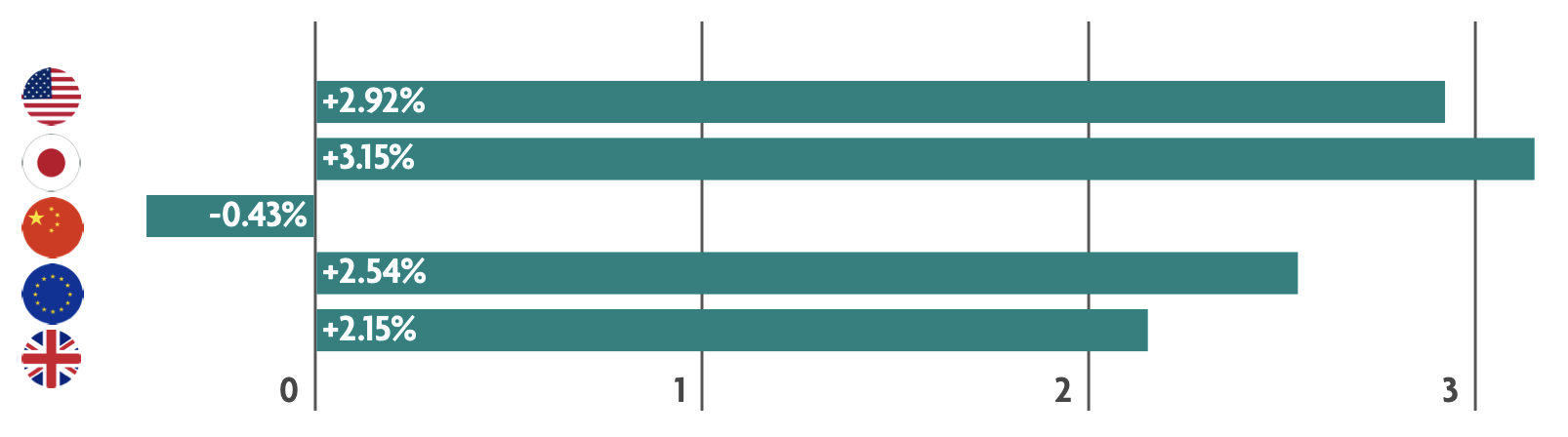

Global market returns were strong last week as trade tensions continue to ease and trade talks continued. In the US, whilst economic data paints a mixed picture, company earnings remain robust. In Japan, the central bank downgrades economic growth and inflation forecasts, whilst in China, the economy is beginning to feel the impact of tariffs. The European economy grew in the first quarter of the year. Meanwhile, business sentiment in the UK deteriorates.

US: Trade tensions ease and company earnings give positive surprise

Positive sentiment early in the week appeared to be driven by a continuation of the prior week’s optimism around de-escalating trade tensions, with President Donald Trump rolling back some of his initial tariffs on cars and auto parts and an announcement that a major trade deal was nearing the finish line. Later in the week, the focus shifted to earnings as many companies reported first-quarter results. Despite some tariff related uncertainty, sentiment remained positive as investors seemed willing to wager that businesses would be able to weather slowing economic growth and tariff-fuelled disruptions. Data published during the week painted a mixed picture of the US economy. On one hand, demand for workers appears to be cooling, but on the other, unemployment remained stable, and employers added more jobs in April than economists expected. Meanwhile, data showed that the U.S. economy contracted for the first time in three years during the first three months of 2025.

Japan: Central bank holds rates and downgrades growth and inflation forecasts

With the Bank of Japan holding rates steady and downgrading its growth and inflation forecasts, investors’ expectations grew that the timing of the central bank’s next interest rate increase could be delayed. While tentative global trade optimism lifted sentiment, bilateral trade negotiations between the U.S. and Japan remained at the preliminary stage, with both sides searching for common ground. Domestically, the latest economic data releases signalled that Japan’s economy is facing challenges, showing that business conditions in the manufacturing sector continued to weaken in April. Separate data showed that both industrial production and retail sales underwhelmed in March.

China: Economy shows initial impact of tariffs

On Friday, China said it was considering the possibility of holding trade talks with Washington, indicating a potential thaw in the U.S.-sparked trade war. Meanwhile, reports suggest that China has started to exempt some U.S. goods from tariffs covering roughly USD 40 billion worth of imports. A pair of indicators gave the first official snapshot of China’s economy after the Trump administration raised total tariffs on most Chinese goods to 145% in April, which manufacturing showing a contraction in business activity and services slowing down. While a trade war with the U.S. could deliver a shock to Chinese exports and economic confidence, Beijing should have the financial capacity to reduce their impact and could roll out fiscal stimulus in stages as it assesses the economic costs of tariffs

Europe: Economic growth accelerates in first three months of 2025

Economic growth in the eurozone accelerated in the first quarter of 2025 and by more than economists had expected. Spain and Italy’s economy grew strongly; Germany and France returned to growth, registering small increases. Meanwhile, eurozone headline inflation remained at 2.2% in April—a higher reading than economists had expected. Still, indicators of business and consumer optimism have dimmed since the April 2 announcement of U.S. reciprocal tariffs, which could impact economic activity. As an example, Economic confidence and consumer sentiment weakened in April.

UK: Housing market and business sentiment dip

The UK housing market showed signs of losing momentum. The Nationwide Building Society’s house price index fell in April, as demand from first-time buyers fell off after the end of a tax discount on home purchases. Separately, the Bank of England said that new mortgage approvals declined for a third consecutive month in March. Business sentiment deteriorated in April amid concerns about the impact of U.S. tariffs and higher employment costs, according to Lloyds Bank. Its widely followed business barometer—a measure of confidence among companies—fell to 39%, its lowest level since January.

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.