Weekly Market Update – 9th June 2025: Markets Hold Firm as US Jobs Data Surprises

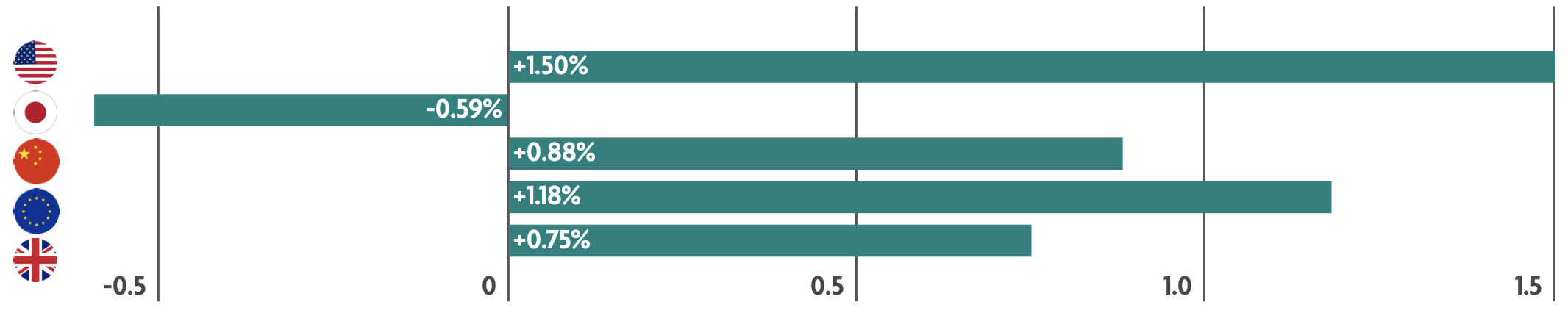

A more muted week for global markets. In the US, trade talks continue to be the focus, and the jobs market appears to be more resilient than many expected. Europe appears to be in a good place when it comes to inflation and economic growth, meanwhile some areas of concern remain in China and Japan.

US: Stocks close higher as Job growth slows in May but holds up better than expected

Equity markets posted gains for another week, with smaller companies doing particularly well, as did technology stocks due to upbeat sentiment around artificial intelligence related stocks. Trade agreements also remained a notable talking point during the week, with tensions between the U.S. and China continuing to re-escalate following social media comments from President Donald Trump at the end of the prior week. However, on Thursday, Trump and President Xi Jinping held a phone call that “resulted in a very positive conclusion for both countries,” according to a social media post from President Trump, which gave investors some hope that the issues could be resolved. In economic news, all eyes were on the job markets, with job growth slowing in May but doing better than many had expected which was seen as positive. Elsewhere, indicators show that manufacturing activity continues to contract for the third month in a row and services activity contracts for the first time in 11 months.

Japan: Trade talks and wages lag inflation

There was no apparent agreement in the trade talks between the U.S. and Japan, although the talks reinforced preparation for an agreement to potentially be announced in June at the G7 summit. On the economic data front, household spending fell in April. Wages after inflation also declined in April, as inflation continued to outpace the wage hikes granted by employers. The Bank of Japan emphasised that, despite some pockets of weakness, Japan’s economy is undergoing a moderate recovery. The central bank also reiterated its readiness to raise interest rates again if its economic and inflation projections continue to materialise.

China: Could weak manufacturing lead to more stimulus?

Mainland Chinese stock markets advanced as a batch of weaker-than-expected economic indicators raised hopes that the government would roll out more stimulus. Data showed that China’s manufacturing sector suffered its biggest decline since September 2022, reflecting the impact of U.S. tariffs on smaller exporters. This supported the view that Beijing needs to roll out more incentives to boost consumption as it tries to offset the impact of U.S. tariff hikes.

Europe: European Central Bank cuts Interest Rates

Markets rose as inflation slowed, and the European Central Bank (ECB) cut interest rates. Stronger than expected U.S. jobs data also appeared to allay fears of a recession. As expected, the ECB trimmed its key interest rate to 2%, the lowest level since 2022. President Christine Lagarde said that the ECB had “nearly concluded” their interest rate cutting cycle, the ECB has delivered eight interest rate cuts since July 2024. Financial markets appear to expect one more interest rate reduction, probably in the autumn, as the central bank assesses the risk to growth and inflation posed by trade policy uncertainty.

UK: Bank of England talks about uncertainty

The Governor of the Bank of England (BoE) Andrew Bailey stressed that the path for interest rates “remains downwards” but added that “how far and how quickly (rates are lowered) is now shrouded in a lot more uncertainty.” Meanwhile, according to Nationwide, UK house prices rose more than expected in May, supported by low unemployment, strong wage growth and easing mortgage rates. All eyes remain on the government spending plans with health and defence set to be prioritised over other areas.

Lets Keep in Touch

To learn more about personal finance, sign up to our monthly newsletter

Thank you for subscribing!

Have a great day!

Content provided by Omnis Investments.

*Source: Bloomberg. All performance measured in local currency.

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.